Marvell Technology Stock Is Struggling. Jim Cramer Still Thinks It’s a Buy.

Marvell Technology (MRVL) found itself under pressure as its stock plunged over 8% on May 7. The drop came in the wake of the company’s decision to shelve its much-anticipated Investor Day, originally slated for June 10.

Citing a “dynamic macroeconomic environment,” Marvell now intends to reschedule the event to sometime in 2026. The abrupt move rattled investor confidence and raised concerns around the stock’s near-term trajectory. Some analysts flagged the delay as a red flag.

But not everyone was ready to throw in the towel. TV personality Jim Cramer didn’t mince words. He called the broader selloff in shares “ridiculous,” and noted that the stock remains near the same level it held before the company leaned into artificial intelligence (AI).

For Cramer, the message was simple: Marvell is a buy, and it is time to act.

About Marvell Stock

Marvell Technology (MRVL) is a fabless designer, developer, and marketer of analog, mixed-signal, and digital signal processing integrated circuits. With a commanding market cap of $51.5 billion, it specializes in tightly knit System-on-a-Chip and System-in-a-Package offerings, grounded mainly in ARM-based architecture.

In just a span of a month, Marvell’s stock has surged by nearly 21%, a move that signals growing investor conviction.

Marvell Surpasses Q4 Earnings

On March 5, Marvell took the stage with its fiscal 2025 fourth-quarter results, which tiptoed just ahead of the Street’s expectations. Revenue touched $1.82 billion, marking 27.4% year-over-year growth and narrowly surpassing the analysts’ forecast of $1.8 billion. The engine behind this upswing was the company’s data center segment, which roared ahead with a 78.5% year-over-year increase.

Marvell’s adjusted EPS climbed 30.4% from a year ago to $0.60, nudging past the $0.59 consensus. The company wrapped up the year with AI revenue well above its $1.5 billion target set during April 2024’s AI day and is now eyeing a significant outperformance against its $2.5 billion fiscal 2026 goal.

Shareholders had reason to smile too, with $52 million returned through cash dividends and $200 million spent on stock buybacks. Management now anticipates Q1 2026 revenue of $1.875 billion and adjusted EPS between $0.56 and $0.66.

Meanwhile, analysts expect Q1 2026 EPS to rise 450% year over year to $0.44, leap 127.2% to $2.09 for the full fiscal year 2026, and hit $2.76 in 2027, a further 32.1% climb.

What Do Analysts Expect for Marvell Stock?

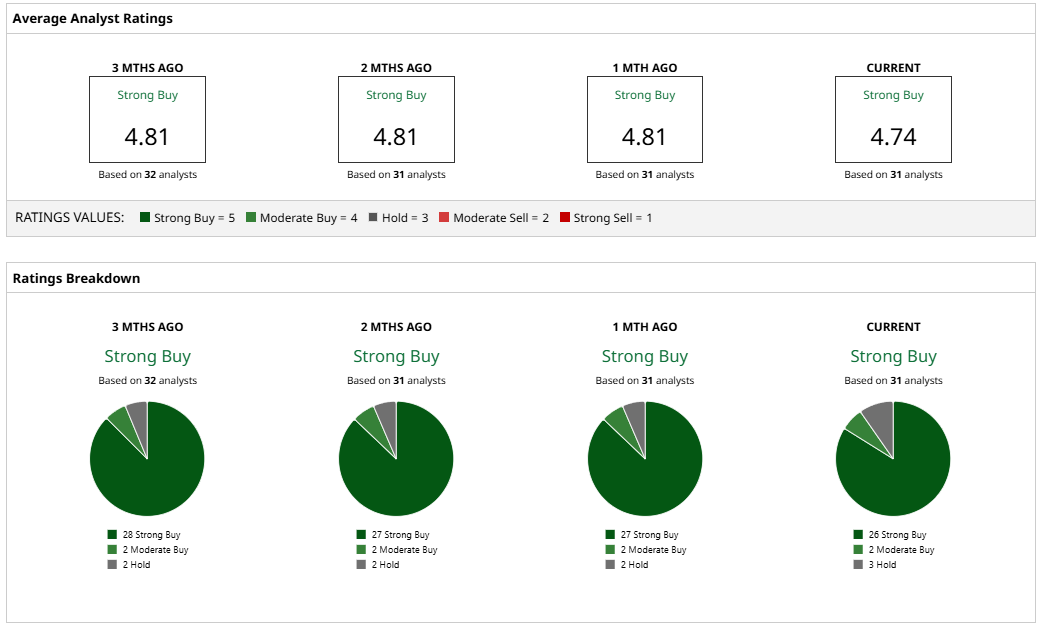

The stock has clinched a solid “Strong Buy” consensus, a clear signal that Wall Street sees more tailwinds than turbulence ahead. Of the 31 analysts tracking MRVL, a commanding 26 have issued a “Strong Buy,” while two have opted for a more measured “Moderate Buy.” Just three have taken a cautious stance, placing a “Hold” on the stock.

The average price target of $107.48 represents potential upside of 67%, while the Street-high target of $188 signals a possible surge of 193% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.