Netflix Stock Hasn’t Gone Anywhere in 3 Months. How Should You Play NFLX Here?

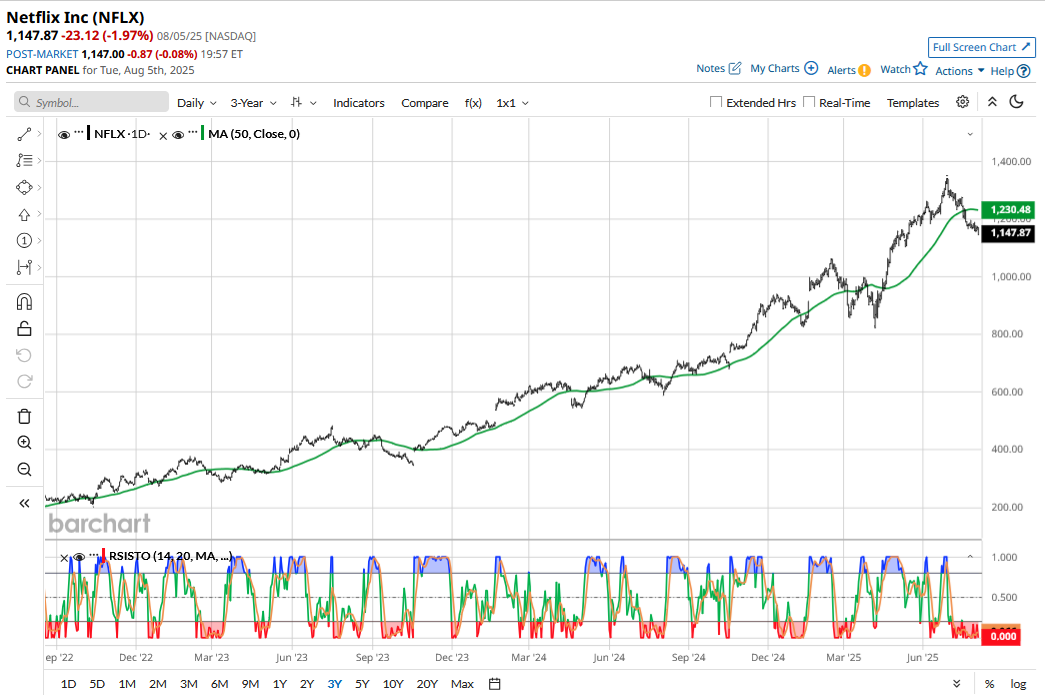

While Netflix stock (NFLX) outperformed the market and the broader tech space in the first four months of the year, it has since lost momentum. The stock has gained just about 1.7% over the last three months while the S&P 500 Index ($SPX) is up a cool 12.4% over the period.

Netflix is down 14% from its 2025 highs and is in correction territory. The stock has been out of favor with the markets for the last few months despite strong financial performance. For instance, it fell 13% in July despite posting a stellar set of numbers for the June quarter and raising its 2025 guidance. In this article, we’ll examine whether Netflix is now nearing the “buy zone” following the recent underperformance.

Why Has Netflix Stock Underperformed Over the Last 3 Months?

To begin with, let’s understand why Netflix stock has underperformed the markets over the last three months. NFLX’s rally in the first four months of the year was backed by a supportive macro environment as it was seen as a defensive play amid trade tensions. For most users, their Netflix subscriptions won’t be the first discretionary spending or subscriptions to be axed in difficult economic times.

As the trade uncertainty started easing, investors pivoted to more cyclical names, which lowered the appeal for defensive plays like Netflix. It didn’t help that Netflix’s forward price-earnings (P/E) multiple expanded into the 50s, which even some of the bulls found hard to justify.

Netflix’s forward P/E is now 44.9x while the P/E-to-growth multiple is 1.97x. While the multiples are still not mouthwatering, they are digestible, and the risk-reward looks a lot more balanced now.

Should You Buy Netflix Stock Now?

Netflix has established itself as the preeminent streaming company and came out shining amid the “streaming war.” The streaming industry is in a structural growth phase as users continue to pivot from linear TV to streaming. While the streaming industry’s growth might eventually settle at a lower base, Netflix should be able to capture a significant portion of the incremental growth.

The following factors also bode well for Netflix over the medium to long term.

- Advertisement growth: Advertisement could be the next key growth driver for Netflix as it boasts a growing and highly engaged audience, which will help it charge premium pricing for ad slots compared to other streamers. While Netflix does not provide a dollar number for its ad business, it reiterated that its ad revenues are on track to double in 2025. In the next couple of years, ad revenues will become a significant driver of Netflix’s top line as the company adds more subscribers to the ad-supported tier and its ad sales start taking off. The company has built its own ad tech stack, which will help it improve the overall experience for advertisers as well as subscribers.

- Higher subscription prices: While Netflix might not be able to see the kind of subscription growth it saw in the previous two years amid its password sharing crackdown and rollout of a cheaper ad-supported tier, it should be able to gradually add to its subscription numbers. Moreover, a strong and growing content slate, partnerships with other broadcasters like it did with TF1 in France, and the addition of features like live sports will help Netflix become even more indispensable for users, enabling it to raise prices. The company did not rule out the possibility of adding more tiers in the future and making some content exclusive for premium tiers, increasing upsell opportunities.

NFLX Stock Forecast

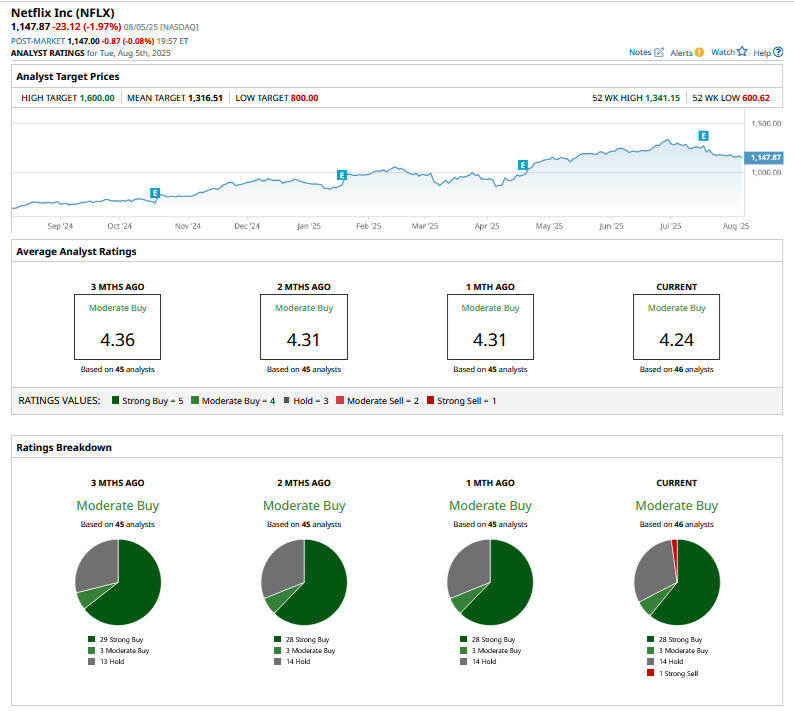

Netflix has a mean target price of $1,316.51, which is 14.7% higher than the Aug. 5 closing price. The stock has received a consensus rating of “Moderate Buy” from the 46 analysts covering the stock.

Analyst sentiment toward Netflix has been subdued for the last couple of months, and while there were some cursory target price hikes following the Q2 earnings last month, Philip Securities downgraded NFLX to a “Sell.” In July, Seaport Global downgraded the stock to a “Hold.” Previously, in May, JPMorgan had also downgraded Netflix stock. The common theme in these downgrades was Netflix’s valuations after the YTD outperformance and its seemingly unattractive risk-reward in the short term.

I believe analyst sentiment might start to turn around soon if Netflix were to fall a bit more from these levels. Overall, while not a screaming buy yet, I find NFLX stock very close to the “buy zone” at these levels.

On the date of publication, Mohit Oberoi had a position in: NFLX . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.