Are Wall Street Analysts Predicting Dominion Energy Stock Will Climb or Sink?

Dominion Energy, Inc. (D) is a Richmond, Virginia-based utility company that provides electricity and natural gas to millions of customers, primarily in the Mid-Atlantic and Southeastern regions. Valued at a market cap of $52.1 billion, the company operates through segments like Power Delivery, Gas Distribution, and Dominion Energy Virginia.

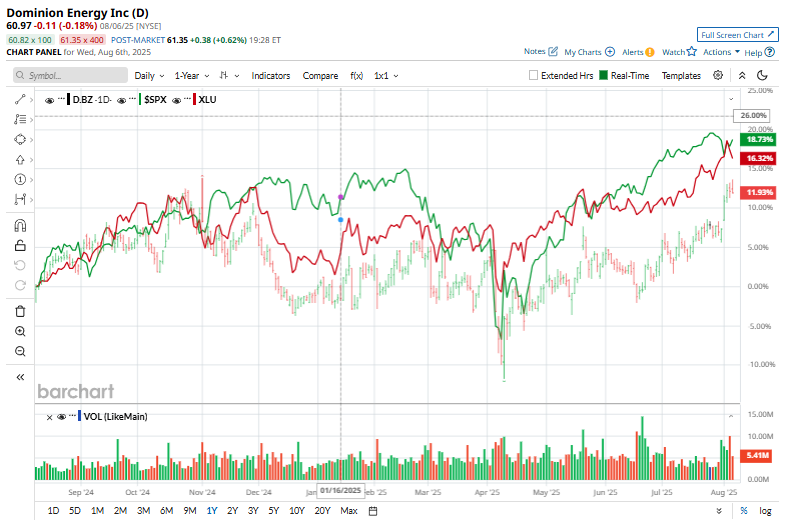

This utility company has lagged behind the broader market over the past 52 weeks. Shares of D have gained 12.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.1%. However, on a YTD basis, the stock is up 13.2%, outpacing SPX’s 7.9% upstick.

Narrowing the focus, D has also underperformed the Utilities Select Sector SPDR Fund’s (XLU) 17.5% uptick over the past 52 weeks and 17.5% rise on a YTD basis.

On Aug. 1, Dominion Energy released its second-quarter earnings, and its shares surged 3.4%. Its non-GAAP earnings reached $0.75 per share, reflecting a 14.5% year-over-year increase, which matched expectations. Revenue climbed 9.3% to $3.81 billion, slightly below forecasts by about $40 million. The company maintained its full-year 2025 earnings guidance of $3.28 to $3.52 per share.

For the current fiscal year, ending in December, analysts expect D’s EPS to grow 22.4% year over year to $3.39. The company’s earnings surprise history is robust. It topped the consensus estimates in each of the last four quarters.

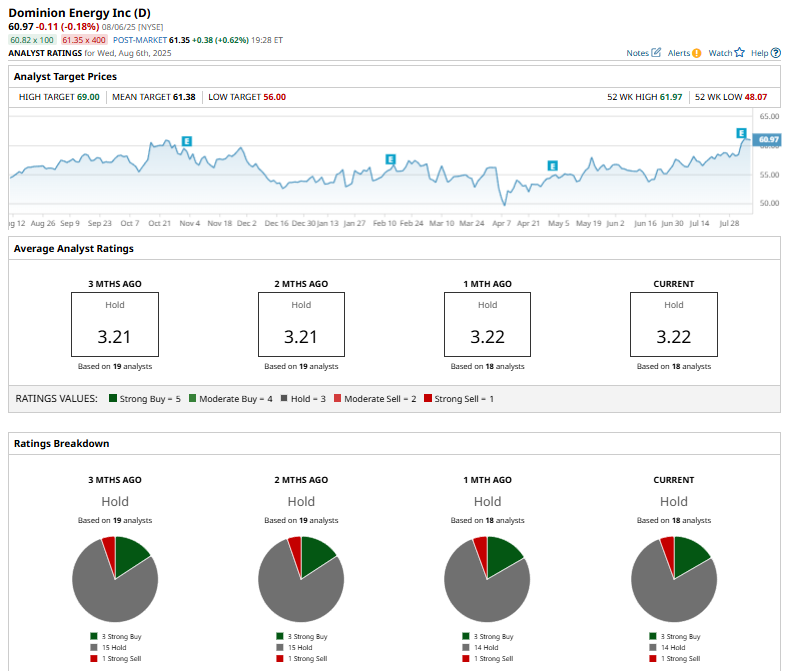

Among the 18 analysts covering the stock, the consensus rating is a “Hold,” which is based on three “Strong Buy,” 14 “Hold,” and one “Strong Sell” rating.

On July 15, JPMorgan Chase & Co. (JPM) analyst Jeremy Tonet reaffirmed an "Underweight" rating on Dominion Energy, citing a consistent strategic outlook. However, the firm raised its price target from $53 to $56.

The mean price target of $61.38 represents a marginal premium from D’s current price levels, and the Street-high price target of $69 suggests an upside potential of 13.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.