Robinhood Stock Seemingly Can’t Be Stopped in 2025. Is It Too Late to Buy HOOD Here?

/Robinhood%20app%20on%20phone%20by%20Andrew%20Neel%20via%20Unsplash.jpg)

Robinhood Markets (HOOD) continues to fly in the face of expectations in 2025. The retail trading pioneer has come out with another quarter of furious growth, beating Wall Street estimates handsomely and remaining the year’s top-performing large-cap U.S. tech stock. With steady revenue growth, rising profitability, and millions of new accounts funded, the company is quickly turning into a full-spectrum financial services platform.

But in the wake of this stellar showing, and with a Bitstamp integration and Robinhood Banking coming in the future, the issue for investors is whether the biggest potential gain has been missed. Broader macro positives and an explosion in derivatives and cryptocurrency trading have increased platform assets and operating costs and left Spotify with high multiples, possibly stifling further appreciation.

About Robinhood Stock

Robinhood Markets (HOOD) is a financial services company headquartered in Menlo Park, California, best known for being the pioneer of commission-free stock as well as cryptocurrency trading. With a market capitalization of about $93.4 billion, Robinhood now presents itself as a complete wealth and asset management platform.

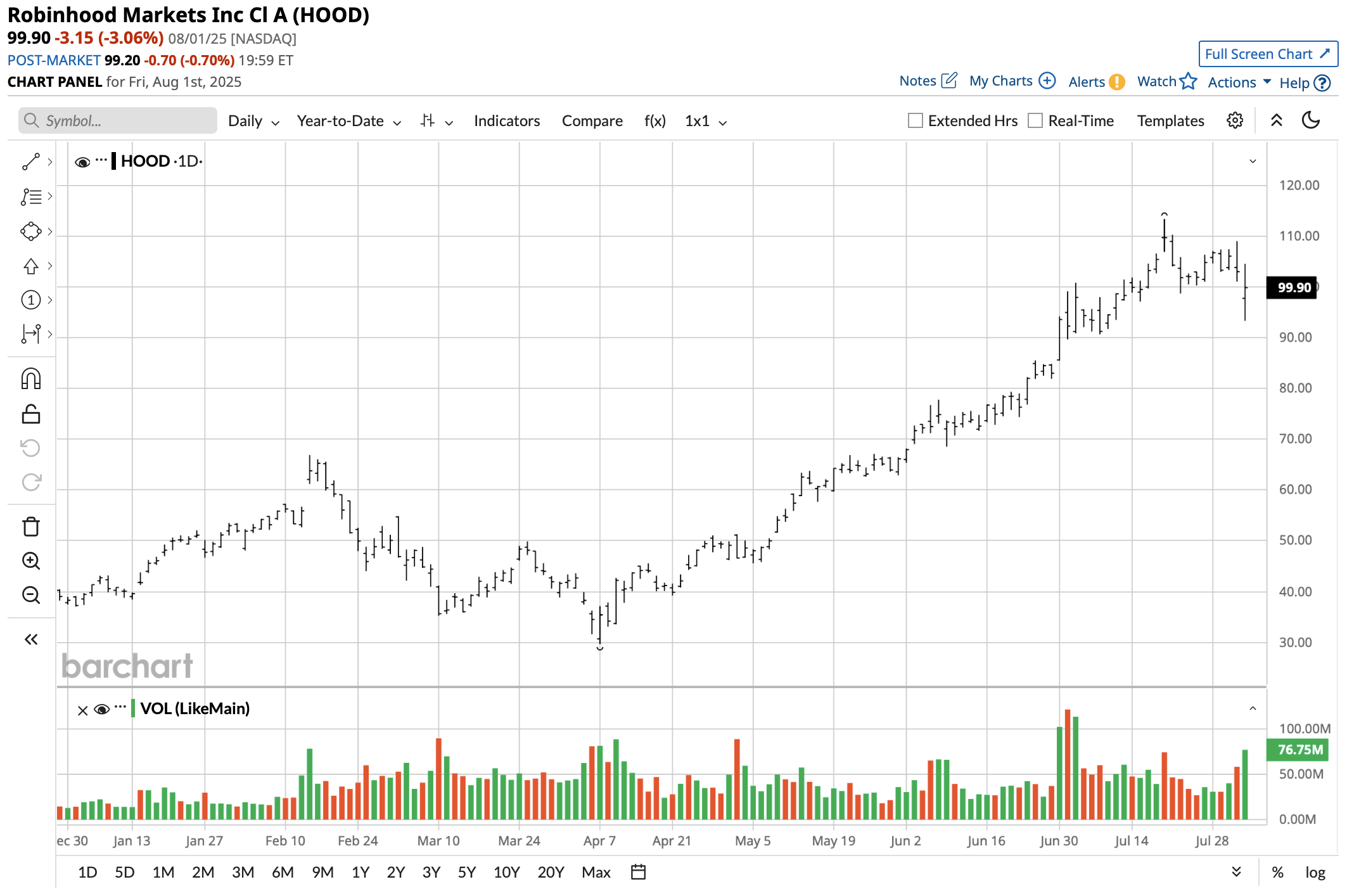

HOOD stock surged 178% year-to-date and 500% in the past 12 months, registering the best large-cap technology stock performance in 2025 thus far. This outperforms the S&P 500 Index’s ($SPX) modest gain of 7.8% YTD. However, the stock fell 3% after earnings last week, possibly due to forward expense commentary.

The valuation is stretched. Robinhood is trading at 69.9x forward price-earnings as well as a high 31.9x price-sales ratio, considerably higher than fintech and broker-dealer industry multiples. Its price-book is at 11.67x, indicative of aggressive growth assumptions as well as premium investor attitudes. To justify these multiples, Spotify will need to continue to execute in new verticals such as banking, sports betting, and asset tokenization.

Robinhood Wins on Earnings

Robinhood surged in the second quarter, producing EPS of $0.42, much higher than the $0.31 consensus estimate. Revenue was up 45% to $989 million, defeating expectations of $908 million. Net income grew by more than double to $386 million, and adjusted EBITDA grew 82% to $549 million.

Management anticipates Q3 remaining strong, with the July net deposit standing at $6 billion already as well as healthy trading across all asset classes. Annual expense guidance was, however, bumped higher to $2.15 billion to $2.25 billion, driven by the Bitstamp purchase as well as planned investments in Robinhood Banking as well as prediction markets.

The quarter also registered sharp jumps in high-margin segments. The options revenue was $265 million, and the net interest income rose 25% at $357 million, boosted by securities lending as well as sweep account returns. Combined transaction-based revenue was strong at $539 million.

The next quarterly earnings report is slated for release in early November, allowing investors several months of time to internalize the effects of forthcoming product releases and integrations.

What Do Analysts Expect for Robinhood Stock?

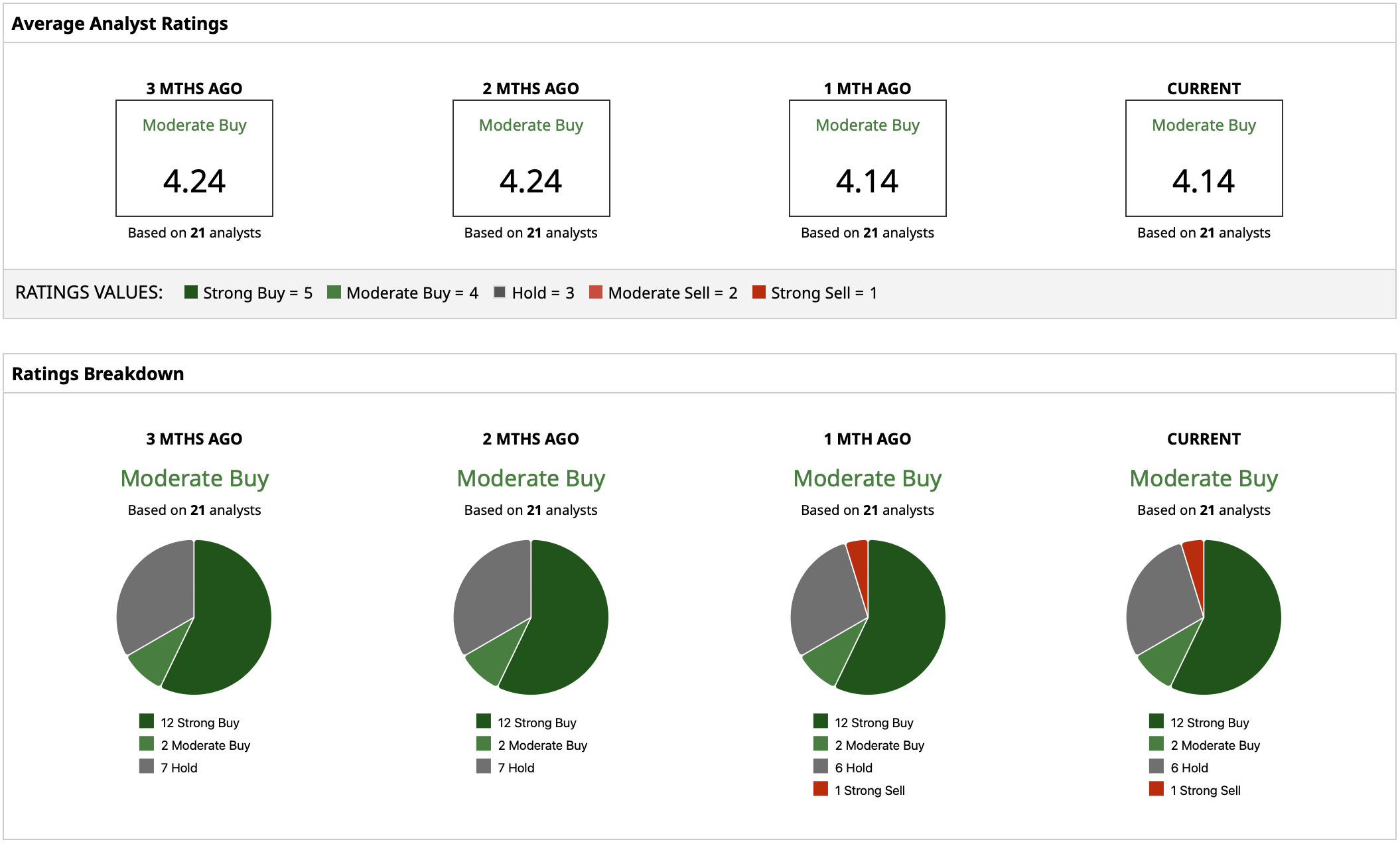

Robinhood has 21 analysts in coverage who give it a “Moderate Buy” consensus rating. 14 of the analysts cover it as a “Buy” or “Strong Buy,” six as a “Hold,” and one as a “Sell.” Its average target of $104.58 is roughly in line with its current trading price. Its high $130 target amounts to a 25% potential gain.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.