Airbnb Tops Q2 Estimates, But Here’s Why ABNB Stock Isn’t a Buy

/Airbnb%20Inc%20logo%20with%20red%20background%20by-%20viewimage%20via%20Shutterstock.jpg)

Airbnb’s (ABNB) second-quarter results released on Aug. 6 exceeded expectations as travel demand remained resilient and the company saw a notable uptick in the number of nights booked. Yet, the market responded negatively, sending ABNB stock down more than 7% in early trading today. The pullback was driven by an expected slowdown in the company’s growth in the second half of 2025.

Airbnb Delivers Strong Q2 Performance

Airbnb, the popular platform for booking homestays, experiences, and services, reported $3.1 billion in revenue, a 13% increase from the same time last year. The company also boosted its profitability, earning $1 billion in adjusted EBITDA with a 34% margin, up from 32.5% a year ago. Net income rose to $642 million, or $1.03 per share, beating analyst expectations. Airbnb saw strong double-digit growth in net income during the second quarter, which helped boost its cash flow. ABNB reported $1 billion in free cash flow for Q2.

From the regional standpoint, Latin America led the charge with high-teens growth. It was followed by Asia Pacific in the mid-teens. At the same time, ABNB’s operations in Europe, the Middle East, and Africa (EMEA) marked mid-single digit growth, while North America lagged with low-single-digit growth. Overall, Airbnb recorded 134 million nights and experiences booked during the quarter, up 7% compared to the same period last year.

What continues to work in Airbnb’s favor is its focus on enhancing its core business. Operational improvements across areas like checkout, guest messaging, and payment flexibility supported revenue growth. The company is also leaning into AI to improve customer service, expanding its AI-powered agent to cover all U.S. users, leading to a 15% reduction in the need for human support.

Airbnb’s international expansion strategy is gaining traction. Bookings in its newer markets have consistently grown at about double the pace of its core regions for six consecutive quarters. This reflects its efforts to tailor offerings to local markets, boost brand visibility, and attract more traffic.

The company is also laying the groundwork for longer-term growth through new services. In May, Airbnb expanded its platform beyond lodging with the launch of services and experiences. Although still early, Airbnb reported positive feedback and strong interest from hosts. Notably, this move can help better monetize the traffic it receives on its platform.

Here’s Why Airbnb Stock Isn’t a Buy

However, even with these tailwinds, the outlook is what raises concern. Management warned that year-over-year comparisons will get “tougher” in the back half of 2025, potentially weighing on growth rates. For Q3, the company expects revenue between $4.02 billion and $4.1 billion, representing growth of 8% to 10%. Nights and experiences booked are expected to grow at a pace similar to Q2, with modest increases in average daily rates (ADR), primarily due to currency effects.

Profitability is expected to remain solid, with Q3 adjusted EBITDA projected to exceed $2 billion. However, margins will likely be lower than last year due to investments in future growth and regulatory initiatives, a trend expected to persist into Q4.

Despite solid fundamentals, Airbnb stock has lagged behind the broader market this year. Its stock is trading in the red. In comparison, the S&P 500 Index ($SPX) has jumped 8.5% year-to-date.

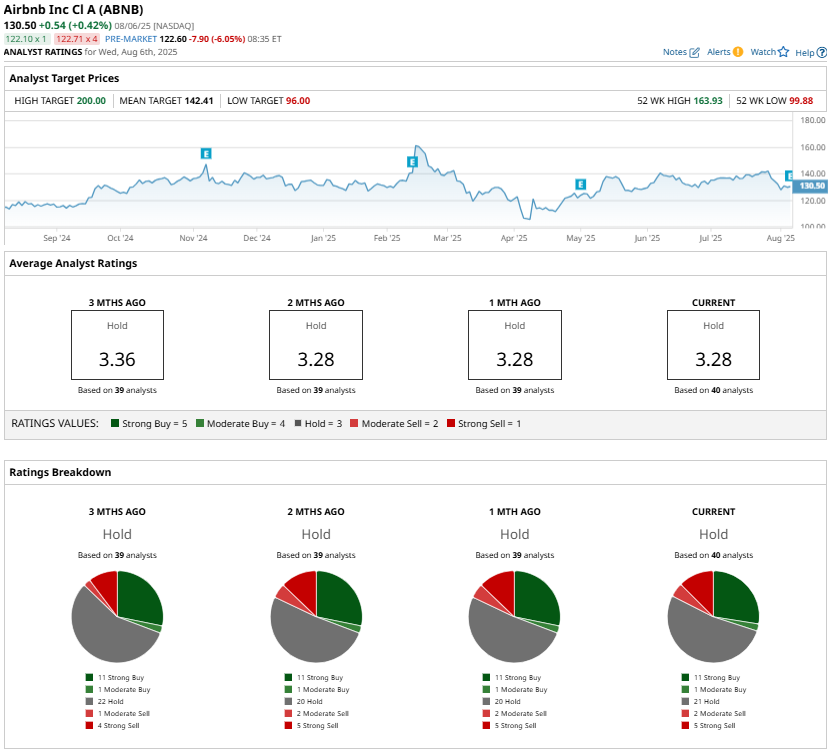

With management signaling a growth deceleration and margin pressure, the stock’s near-term upside appears limited. Wall Street analysts are largely cautious, with a consensus rating of “Hold.”

The Bottom Line

Airbnb is a profitable and growing company with strong fundamentals and plenty of long-term potential. Travel demand is steady, new services are gaining momentum, and international expansion is proving effective. However, with growth expected to slow in the coming quarters and the stock already underperforming, now may not be the best time to jump in.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.