Are Wall Street Analysts Predicting American Electric Power Stock Will Climb or Sink?

With a market cap of $60.8 billion, American Electric Power Company, Inc. (AEP) is one of the largest integrated electric utilities in the United States, serving over 5.6 million customers across 11 states. The company generates, transmits, and distributes electricity through a diverse mix of energy sources, while operating extensive transmission and distribution infrastructure.

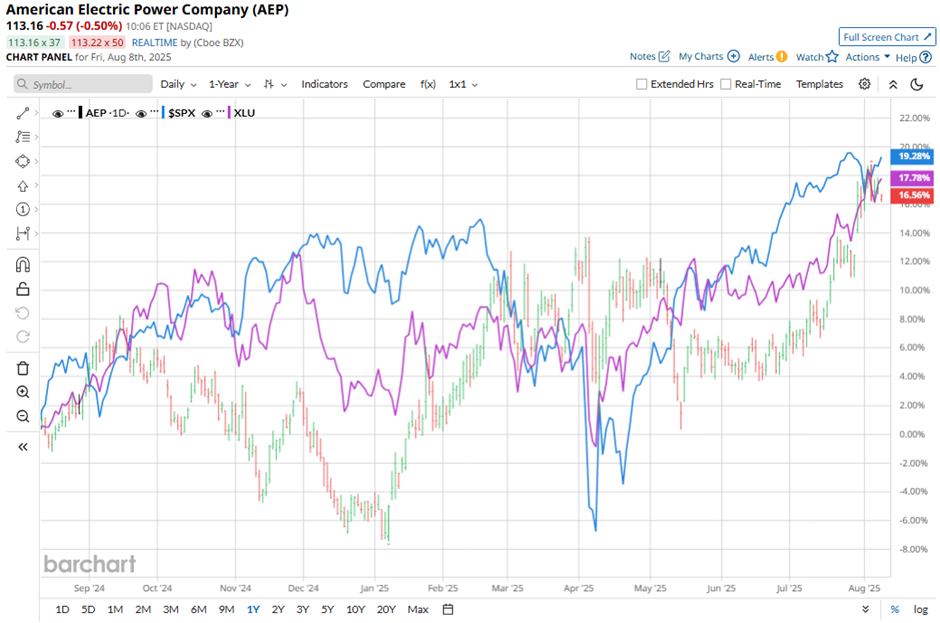

Shares of the Columbus, Ohio-based company have underperformed the broader market over the past 52 weeks. American Electric Power stock has returned 15.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 19.8%. However, shares of AEP are up 22.8% on a YTD basis, outperforming SPX's 8.3% rise.

Looking closer, the utility company stock has lagged behind the Utilities Select Sector SPDR Fund's (XLU) 18.5% return over the past 52 weeks.

Shares of AEP climbed 3.7% on Jul. 30 after the company posted stronger-than-expected Q2 2025 results, with adjusted EPS of $1.43 and revenue reaching $5.1 billion. The earnings beat was driven largely by higher electricity rates obtained through rate case proceedings, reflecting investments and expenses in service delivery. Investor sentiment was further boosted by AEP’s reaffirmation of its full-year profit guidance of $5.75 per share - $5.95 per share, now expected toward the upper end, and plans to unveil a $70 billion five-year capital plan this fall to meet rising U.S. energy demand.

For the fiscal year ending in December 2025, analysts expect AEP's EPS to grow 4.3% year-over-year to $5.86. The company's earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

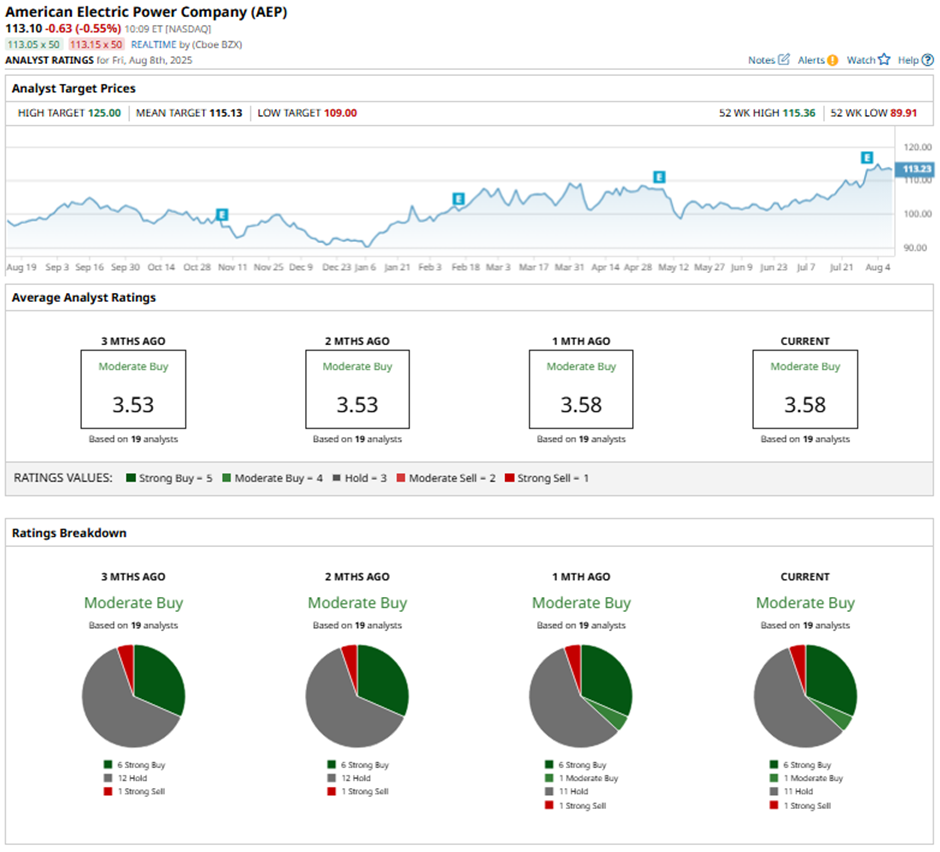

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one “Strong Sell.”

On Aug. 4, Jefferies increased its price target for AEP to $120 and reiterated its “Hold” rating on the stock.

As of writing, the stock is trading below the mean price target of $115.13. The Street-high price target of $125 implies a potential upside of 10.5%.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.