Is Qualcomm the Best Semiconductor Stock to Buy Right Now?

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Valued at $157.4 billion, Qualcomm (QCOM) has positioned itself as a strong contender in the semiconductor space by leading in mobile processors, making a significant push into artificial intelligence across devices, and expanding into automotive, internet of things, and data centers. The company just reported strong fiscal third quarter results and is still on track to meet its ambitious fiscal 2029 goal of $22 billion in combined automotive and IoT revenue.

If the company’s current trajectory continues, it could be one of the best growth plays in the semiconductor industry. QCOM stock is down 3.8% year-to-date, compared to the tech-heavy Nasdaq Composite Index’s ($NASX) gain of 10.9%. Let’s find out if QCOM stock is a buy now on the dip.

Qualcomm’s Snapdragon Processors Are Leading the Charge

In its fiscal 2025 third quarter, the company reported adjusted revenue of $10.4 billion, up 10% year-over-year. Adjusted earnings per share of $2.77 increased by 19% YoY, placing the company near the top of its guidance range. Qualcomm CDMA Technologies (QCT), the company’s core chipset business, generated $9 billion in revenue, up 11% YoY, with Automotive (up 21%) and IoT (up 24%) showing particularly strong growth. Qualcomm’s licensing segment, Qualcomm Technology Licensing (QTL), generated $1.3 billion in revenue.

Qualcomm’s Snapdragon Digital Chassis continues to win contracts in the automotive industry, with 12 new designs introduced this quarter and 50 vehicle launches planned for fiscal 2025. Qualcomm and Xiaomi (XIACY) have signed a multi-year agreement to collaborate on smartphones. Xiaomi’s Snapdragon 8-series processors will power multiple generations of flagship devices in China and around the world, with shipment volumes increasing year after year. The Snapdragon 8 Elite continues to set the standard for mobile innovation, particularly in enabling the transition to AI-powered smartphones. Qualcomm reports that 124 AI smartphone designs have been shipped or announced, and AI adoption is accelerating.

Qualcomm’s push into PCs is only a year old, but it is already gaining traction. The Snapdragon X Series powers devices from Acer, Lenovo, Microsoft (MSFT), Dell (DELL), and Samsung, with over 100 designs planned for commercialization by 2026. Management also stated during the Q3 earnings call that the Snapdragon AR1 Gen 1 platform continues to dominate AI-powered smart glasses. Qualcomm now supports 19 partner designs, including Meta’s (META) AI smart glasses, which have outperformed sales expectations, as well as the new Meta Oakley and expanded Ray-Ban lines.

In Q3, Qualcomm returned $2.8 billion in share repurchases and $967 million in dividends, aligning with its policy of returning 100% of free cash flow. CEO Cristiano Amon forecasts fiscal 2025 to be its second straight year of over 15% year-over-year growth in total QCT non-Apple revenues. Total revenue could increase by 12% with a 16% increase in earnings, in line with consensus estimates. Currently, QCOM stock trades at 12 times forward earnings, lower than its five-year historical average of 21x, making it a reasonable AI-led semiconductor stock to buy now.

New Growth Opportunities

Qualcomm is expanding into data centers with NPU-based AI inference accelerator cards and custom SoCs based on its Oryon CPU. Qualcomm’s planned acquisition of Alphawave IP Group, a leader in high-speed connectivity for data centers, AI, and networking, will strengthen the company's data center strategy. The transaction is expected to close in the first quarter of 2026.

Furthermore, the company is in advanced discussions with a major hyperscaler, with potential revenue beginning in fiscal 2028. Qualcomm also signed a memorandum of understanding with HUMAIN to build advanced AI data centers in Saudi Arabia and beyond.

Qualcomm also sees personal AI devices like smart glasses, wearables, and earbuds as a separate growth category from smartphones. With strengths in connectivity, low-power AI processing, and sensors, the company anticipates becoming the preferred supplier in this space. In Physical AI, Qualcomm is focusing on robotics, automation, and humanoid robots with its automotive-grade silicon, sensing, and AI capabilities. The company estimates that this could be a $1 trillion total addressable market opportunity over the next decade. Financially, the company is in a strong position to invest in its growth strategies. At the end of the third quarter, it had $12.3 billion in cash, cash equivalents, restricted cash, and marketable securities.

What Do Analysts Say About QCOM Stock?

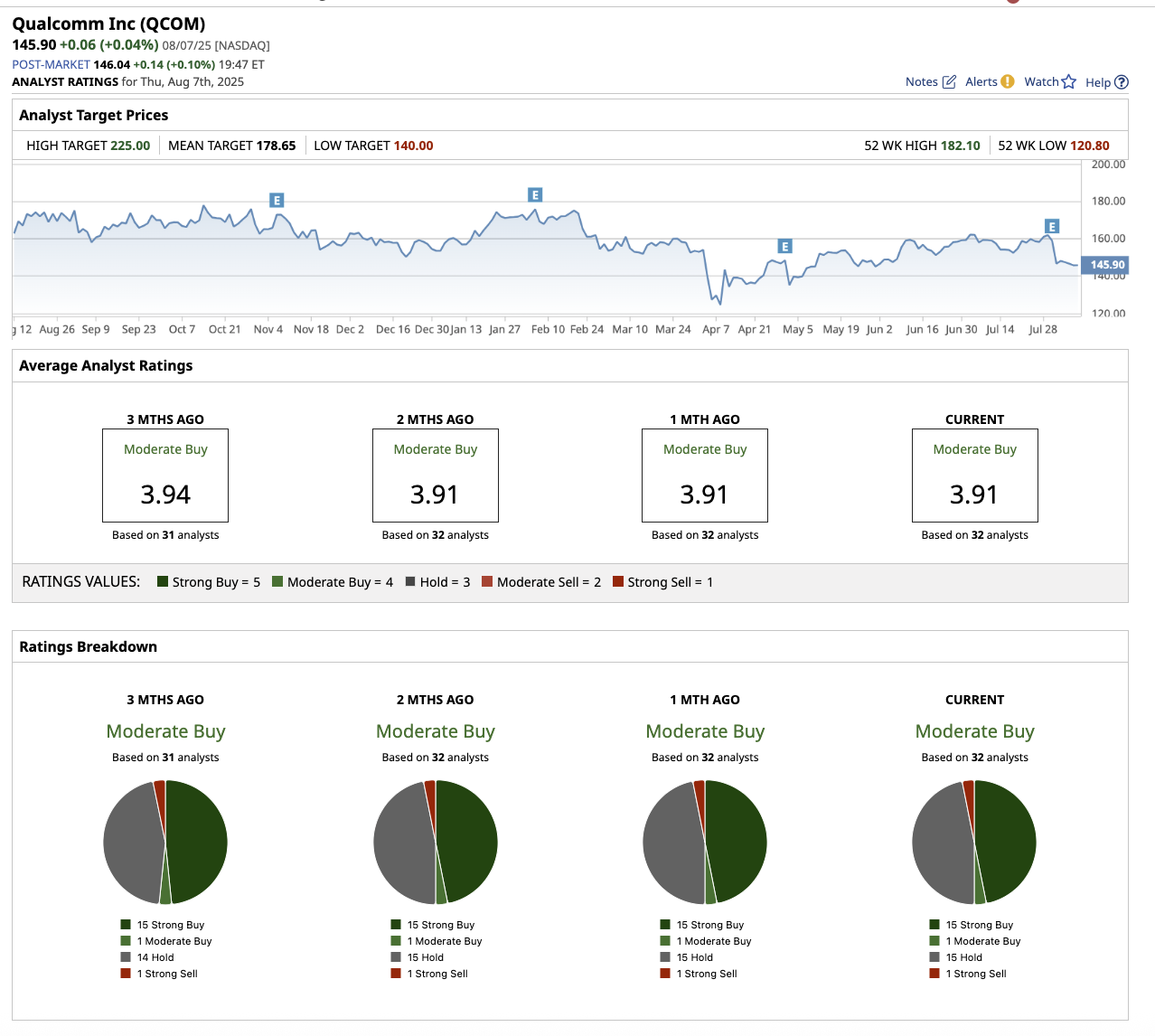

Overall, Wall Street rates QCOM stock a “Moderate Buy.” Out of the 32 analysts that cover the stock, 15 rate it a “Strong Buy,” one suggests a “Moderate Buy,” 15 rate it a “Hold,” and one rates it a “Strong Sell.”

Its average target price of $178.65 suggests an upside potential of 21% from current levels. Its high target price of $225 implies a potential upside of 53% in the next 12 months.

The Key Takeaway

Qualcomm is executing on all fronts. It is strengthening its mobile dominance, expanding into PCs, leading in XR, accelerating automotive and IoT growth, and creating a new revenue stream in data centers. Its aggressive push into AI-enabled devices and infrastructure positions it for long-term double-digit growth, and a strong capital return program continues to reward shareholders, making it an excellent semiconductor stock to grab now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.