This High-Yield (7%) Dividend Stock Is Down Significantly in 2025. Should You Buy the Dip?

Package delivery and logistics leader United Parcel Service (UPS) has now joined an exclusive list of S&P 500 Index ($SPX) companies that offer a dividend yield of more than 7%. However, this was a consequence of the company’s weaker-than-expected second quarter results, in which its earnings missed consensus estimates. Since then, the stock has corrected by nearly 15%, with the company's current market capitalization at approximately $73 billion.

UPS stock now offers a dividend yield of 7.56%, with a payout ratio nearing 90%, which will almost certainly put a halt to its impressive record of 15 consecutive years of dividend growth.

So, is UPS stock, which is down 31% on a YTD basis, an attractive investment option considering its newfound high-yield status? Let’s have a closer look.

Financials Weakening at UPS

In Q2 2025, UPS reported revenues of $21.2 billion, a drop of 2.7% from the previous year. While the core domestic segment reported a marginal YOY decline to $14.1 billion, the international segment witnessed a yearly rise of 2.6% to $4.5 billion. Meanwhile, earnings saw a 13.4% decline in the same period to come in at $1.55 per share, slightly lower than the consensus estimate for $1.56. Notably, this was just the second quarter out of nine that saw an EPS miss.

For the six months ended June 30, 2025, net cash from operating activities dropped to $2.7 billion from $5.3 billion in the year-ago period, which is a matter of concern. However, the company’s liquidity position remained solid as it closed the quarter with a cash balance of $6.2 billion, which was much higher than its short-term debt levels of $1.6 billion.

Finally, the share price decline has brought the stock to undervaluation levels. UPS is now trading at a forward price-earnings ratio of 13.1x, below the sector median of 20.4x and its own five-year average of 17x.

UPS Continues to Look for Stable Growth

Amid tariff issues and an uncertain economic environment, CEO Carol B. Tome sounded guarded about the company’s prospects in the latest earnings call. Tome emphasized that “our second quarter financial results reflect the impact of a complex macro environment.” However, she sounded more confident about the company’s international segment, highlighting that “volume in our China to the rest of the world trade lanes increased by 22.4%, and we nearly doubled our capacity between India and Europe” while confirming plans to acquire Estafeta and Andlauer Healthcare Group (AND.TO), stating, “We expect this acquisition to close before the end of the year.” Estafeta is a Mexican logistics and parcel delivery company with a presence in 95% of the country through 33 warehouses, while Andlauer Healthcare is a Canadian healthcare logistics and supply-chain provider, operating 9 distribution centers and 22 branches across Canada. It also offers specialized transportation services throughout the contiguous 48 U.S. states.

Specifically, through the latter acquisition, UPS is expanding into the more specialized and less cyclical healthcare logistics segment, which is difficult for many competitors to replicate because of its time-sensitive nature and stringent regulatory requirements.

UPS is also accelerating its use of automation. Inside its facilities, artificial intelligence now guides mechanical arms that help sort parcels and unload vehicles. The company expects these systems to lower staffing costs while also reducing workplace injuries. According to industry sources, discussions are underway with Figure AI, a prominent developer of humanoid robots. If these talks result in deployment, such robots could one day be used for certain delivery tasks, creating the potential for considerable cost savings.

UPS has also embraced drones for inventory checks in its warehouses. Also, through its UPS Flight Forward division, it holds FAA authorization to operate a drone delivery network in the United States. That network has been used mainly for urgent medical shipments, but the company is now testing drones that can take off from moving trucks, deliver packages, and return to the vehicle without requiring it to stop.

Overall, UPS is combining AI-driven sorting processes, robotic systems for labeling and materials handling, and forecasting tools to optimize labor scheduling. This is a significant structural redesign of UPS’ physical network aimed at speeding up operations and lowering costs. With services that reach over 200 countries and the largest combined air-and-ground delivery network in the world, UPS remains positioned as the leading global provider of integrated logistics. Viewed in this context, the company’s softer financial performance in the second quarter of 2025 is likely to be seen as a short-term setback rather than a sign of lasting weakness.

However, a material concern for UPS can be its changing dynamic with Amazon (AMZN). UPS announced earlier this year that it plans to reduce Amazon’s shipment share by more than half by the end of 2026. While Amazon is currently its largest client, executives have said that this business generates margins that are below the company’s domestic average. In 2024, revenue tied to Amazon accounted for a substantial 11.8% of total sales. Moreover, as Amazon expands its logistics network and positions itself to deliver for third parties, UPS could face additional pressure on both package volumes and profit margins going forward.

Analyst Opinions on UPS Stock

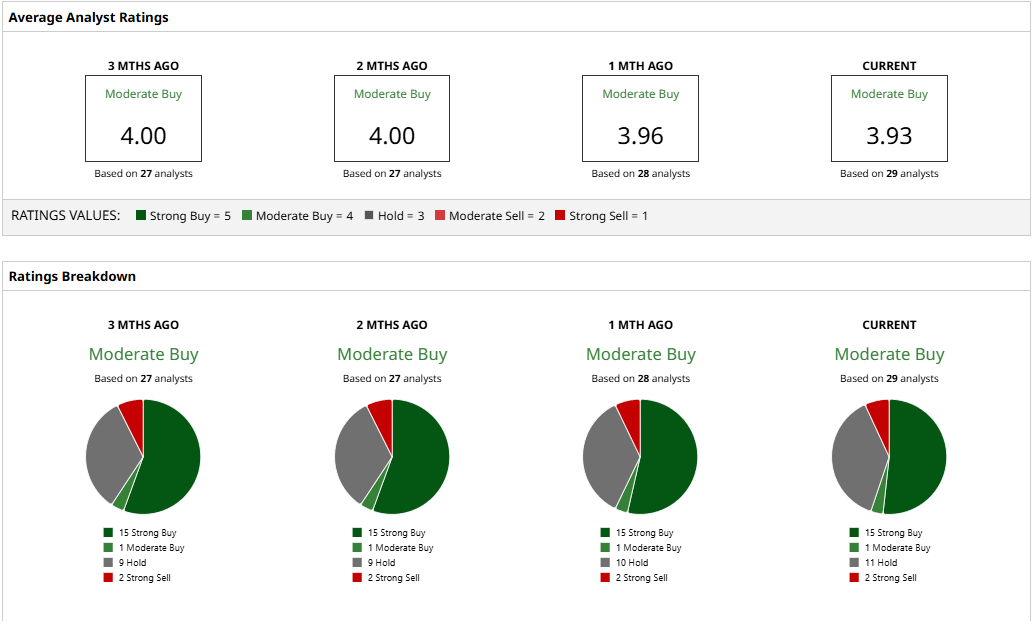

Overall, analysts have deemed the stock a “Moderate Buy” with a mean target price of $107.21. This indicates upside potential of about 24% from current levels. Out of 29 analysts covering the stock, 15 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 11 have a “Hold” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.