Dow Stock Outlook: Is Wall Street Bullish or Bearish?

Valued at a market cap of $15 billion, Dow Inc. (DOW) is a leading global materials science company situated in Michigan. It produces a wide range of chemicals, plastics, and specialty materials used in packaging, infrastructure, mobility, and consumer goods, with operations in over 30 countries.

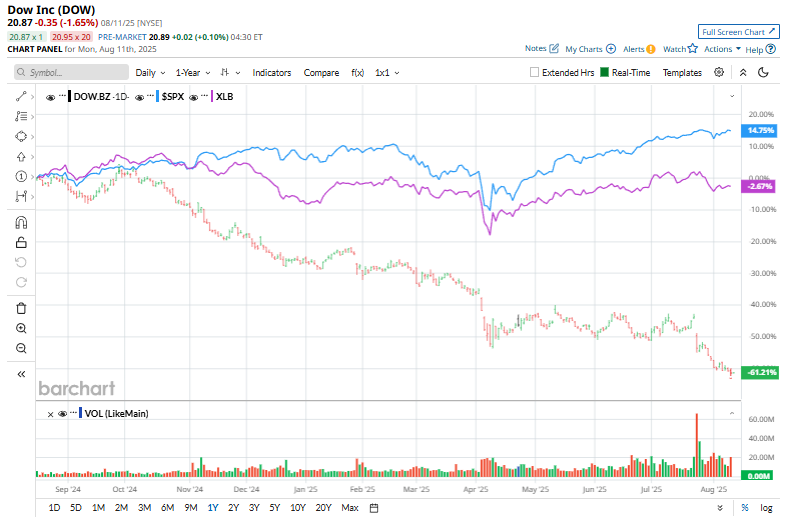

Shares of Dow have struggled to keep up with the broader market considerably over the past year. DOW stock has declined 60.4% over this time frame, while the broader S&P 500 Index ($SPX) is up 19.3%. In 2025, the stock is down 48%, compared to $SPX’s 8.4% rise on a YTD basis.

Narrowing the focus, DOW has also trailed the Materials Select Sector SPDR Fund’s (XLB) marginal drop over the past year and 4.8% gains on a YTD basis.

On Jul. 24, Dow posted a weak Q2 2025, with sales down 7% year-over-year to $10.1 billion and an adjusted loss of $0.42 per share, as all segments saw sharp profit declines and operating cash flow turned negative. Citing a prolonged industry downturn and the need to preserve liquidity, the company cut its quarterly dividend by 50% from $0.70 to $0.35 per share, reducing its yield from about 9% to 5–6% and saving roughly $1 billion annually. As a result, the stock plunged about 17.5%, its steepest drop in years.

For the current fiscal year, ending in December, analysts expect DOW to report a loss of $0.51 per share, down 129.8% from a profit of $1.71 in 2024. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

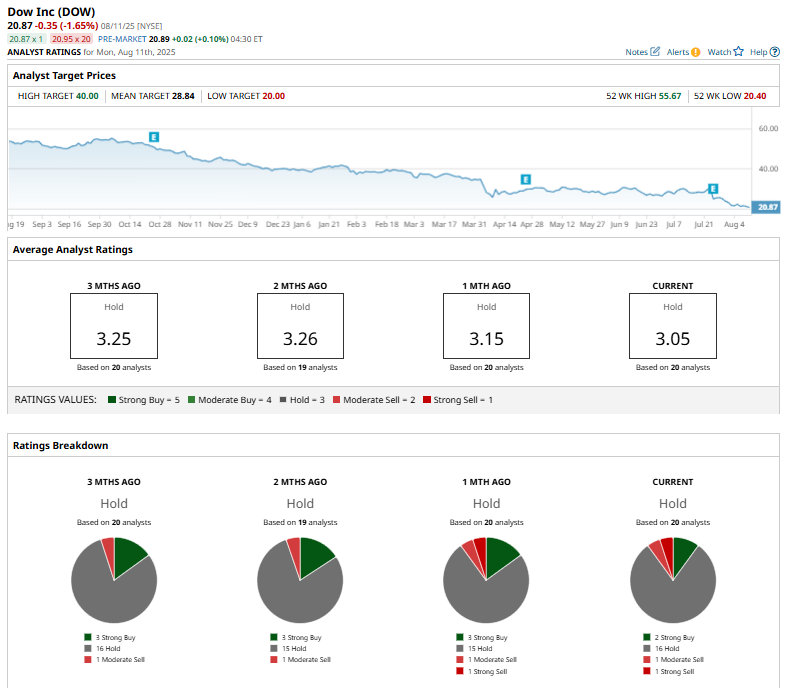

Dow stock has a consensus “Hold” rating overall. Out of 20 analysts covering the stock, two advise a "Strong Buy," 16 suggest a "Hold," one suggests a “Moderate Sell,” and the remaining analyst advocates a “Strong Sell.”

The current consensus is more bearish than a month ago, when three analysts gave a “Strong Buy” suggestion for the stock.

On Aug. 7, UBS Group AG (UBS) analyst Joshua Spector maintained a “Neutral” rating on Dow but lowered the price target by 8% from $25 to $23.

The mean price target of $28.84 suggests a 38.2% premium to the current levels. The Street-high target of $40 represents an impressive upside potential of 91.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.