Is Ford Stock’s Juicy Dividend Still Safe Amid the Global Tariff War?

/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Ford (F) delivered another strong quarter despite headwinds from shifting trade policies, intensifying global tariff disputes, and ongoing cost challenges associated with transforming its business model. Ford’s stock has surged 12.5% year-to-date.

However, dividend investors have another concern. Ford offers an attractive forward dividend yield of 5.4%, excluding special dividends. They question whether Ford’s generous payouts can withstand the weight of a $2 billion tariff bill in 2025 while still allowing for growth in its ambitious long-term plan. Let’s find out what Ford is doing about this.

A Strong Quarter in a Tough Environment

Ford’s dividend yield exceeds the consumer discretionary sector average of 1.9% and rival General Motors’ (GM) yield of 1.1%. Furthermore, its forward payout ratio (the amount of income paid out in dividends) of 43% is low, implying that dividends are currently sustainable, with room for growth.

In the second quarter, Ford generated $2.8 billion in adjusted free cash flow, ending the quarter with $28.4 billion in cash and $46.6 billion in liquidity. Strong liquidity enables Ford to continue investing in growth segments, such as Ford Pro, even during macroeconomic downturns, while maintaining its dividend commitments. Ford reported revenue of $50.2 billion, an increase of 5% year-over-year and $2.1 billion in adjusted EBIT. These results came despite $800 million in net tariff costs, proving that the automaker has found ways to deliver operational improvements despite difficult trade conditions.

One of the biggest safety nets for Ford’s dividend is Ford Pro, the company’s commercial vehicle and services division. Q2 revenue grew 11% to nearly $19 billion. Over the last 12 months, aftermarket sales (parts, software, and services) accounted for 17% of Ford Pro’s EBIT, bringing it closer to the 20% target for next year. This shift to recurring, high-margin revenue makes Ford Pro less cyclical than traditional vehicle sales, which is a significant advantage during global trade disruptions.

Additionally, paid software subscriptions in Ford Pro increased 24% year-on-year to 757,000. CEO Jim Farley emphasized that capital is being directed toward Ford Pro and away from specific EV projects, indicating that Ford is prioritizing profitability and stability over rapid EV expansion, which is encouraging for dividend investors.

The electric vehicle (EV) industry as a whole has been dealing with demand fluctuations and profitability issues. However, Ford’s Model e division more than doubled revenue to $2.4 billion this quarter, with significant margin improvement and lower material costs.

Ford’s next EV push, which Farley described as a “Model T moment,” debuted on August 11 in Kentucky, with a new electric platform aimed at redefining family vehicles in terms of technology, efficiency, and features. This launch, if successful, could have a significant impact on Ford’s long-term market positioning, although near-term EV profitability remains a work in progress. Management boasted that Ford sold more electrified vehicles (EVs + hybrids) than its two main domestic rivals combined, with electrified models accounting for 14% of total U.S. sales.

How Ford Plans to Tackle Tariffs and Trade Policy

Farley stated that Ford expects tariffs to be a $2 billion net cost headwind this year, which the company is actively managing through product strategy, pricing discipline, and targeted capital allocation. Ford’s tariff strategy is to avoid high-volume, generic vehicle segments that require overseas production to remain cost-competitive. Instead, it plans to focus on:

- Trucks and SUVs, where Ford has a dominant market share

- Ford Pro commercial vehicles and services

- Iconic passion products such as the Bronco and Mustang

- Breakthrough EV technology developed and manufactured in the U.S.

The company also plans to save $1 billion in net costs this year (excluding tariffs), with material cost reductions accounting for the majority of the savings. Ford reiterated its capital return policy of returning 40% to 50% of trailing adjusted free cash flow to shareholders by 2025. For the third quarter, the board declared a dividend of $0.15 per share

Given Ford's consistent free cash flow generation, strong liquidity position, diverse profit streams, and ongoing cost-cutting efforts, the current dividend appears sustainable, even in the face of $2 billion in full-year net tariff headwinds. With tariffs already factored in, Ford anticipates adjusted EBIT of $6.5 billion to $7.5 billion and adjusted free cash flow of $3.5 billion to $4.5 billion. This suggests that, despite policy uncertainty, the company believes its core business is strong enough to meet its guidance.

What Is Wall Street Saying About Ford Stock?

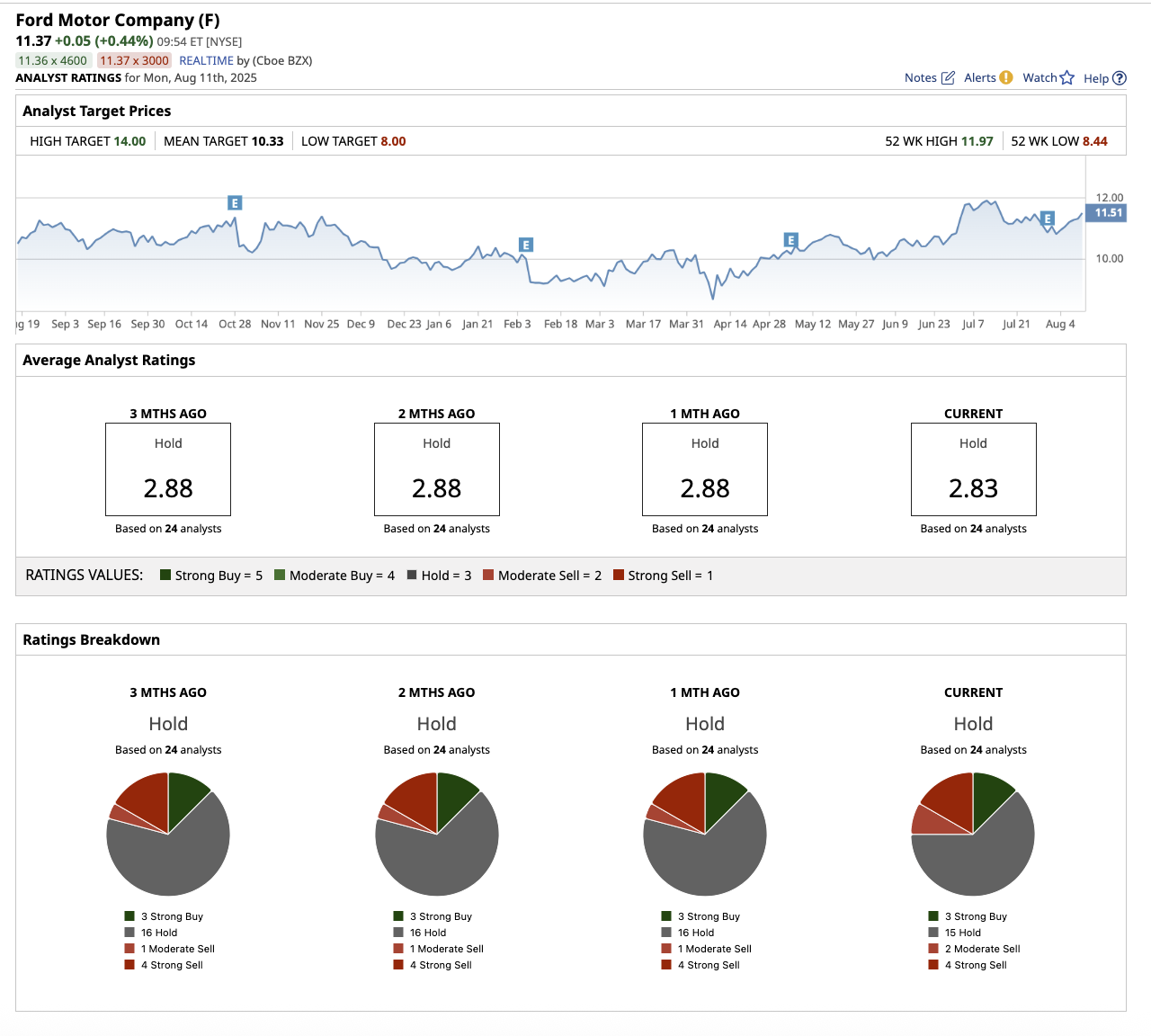

On Wall Street, Ford stock is rated an overall “Hold.” Of the 24 analysts that cover the stock, three rate it a “Strong Buy,” 15 rate it a “Hold,” two say it is a “Moderate Sell,” and four rate it a “Strong Sell.” Ford’s stock has surpassed the average analyst target price of $10.33. However, its high target price of $14.00 implies that the stock could rise as much as 25% from current levels.

The Takeaway: Ford’s Dividend Looks Secure for Now

While risks such as further trade escalation, EV demand volatility, or a sharp industry slowdown remain, Ford’s strong balance sheet, diverse operations, and disciplined capital allocation suggest that its dividend payouts are safe for now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.