Builders Firstsource Stock: Is Wall Street Bullish or Bearish?

/Builders%20Firstsource%20Inc%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Irving, Texas-based Builders FirstSource, Inc. (BLDR), with a market cap of approximately $15.2 billion, operates in the building products and equipment sector, specifically within the lumber and building materials dealers industry. The company is a leading supplier of structural building products, prefabricated components, and value-added services in the U.S. Founded in 1998, Builders FirstSource has expanded to around 585 locations across 43 states, serving 92 of the top 100 Metropolitan Statistical Areas.

Builders FirstSource has underperformed both the broader market and its industry peers, with a year-to-date (YTD) decline of around 3.8% and a 52-week plunge of 10.3%.

In contrast, the S&P 500 Index ($SPX) remains in positive territory, up 9.6% on a YTD basis and surging 20.6% over the past 52 weeks. Meanwhile, the SPDR S&P Homebuilders ETF (XHB) has rallied by 6.6% this year and returned around 4% over the past year.

Multiple factors have driven this underperformance. The Q2 2025 earnings report, released on July 31, featured an adjusted EPS of $2.38, which was above the consensus estimate of $2.35 but below the prior-year quarter value of $3.50. The company, on the other hand, missed topline expectations with revenue coming in at $4.2 billion versus $4.3 billion forecast, resulting in a stock dip.

Furthermore, net sales declined 5% year-over-year (YoY), gross margins decreased by 210 basis points, and adjusted EBITDA fell by 24.4% annually, highlighting pressures from weak housing starts and margin normalization in the single- and multi-family segments.

Operationally, however, the company delivered $22 million in productivity savings as of the end of July, aiming for $45 million to $65 million in full-year 2025, reflecting a proactive cost-management focus amidst challenging demand.

For the current fiscal year, ending in December 2025, analysts expect Builders FirstSource’s EPS to decline 38.6% YoY to $7.10, on a diluted basis. The company’s earnings surprise is mixed. It beat the consensus estimates in three of the last four quarters, while falling short on one other occasion.

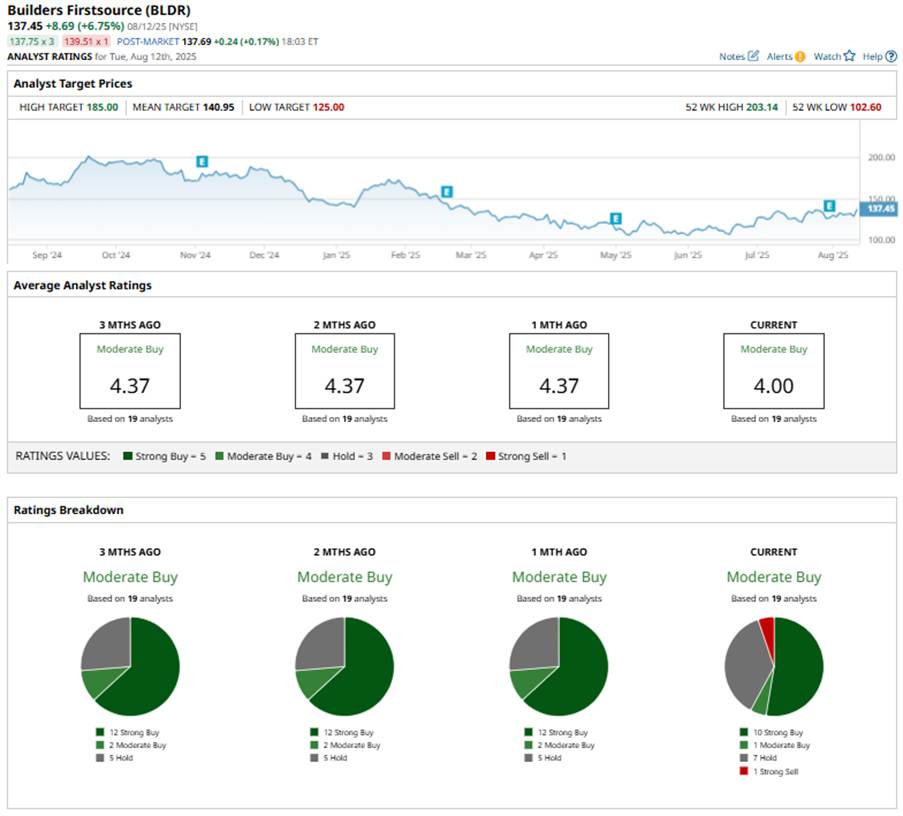

Among the 19 analysts covering BLDR stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy,” one “Moderate Buy,” seven “Hold,” and one “Strong Sell” ratings.

The current configuration has remained largely consistent over the past few months. But compared to three months ago, it reflects a slight increase in bearish sentiment, with one “Strong Sell” rating now.

Earlier this month, DA Davidson cut BLDR’s price target to $125 from $135 while maintaining a “Neutral” rating, citing persistent single-family demand pressures that can affect profitability.

Also, on July 31, Barclays trimmed its price target to $135 from $137 while keeping an “Overweight” rating, citing cyclical volume pressure but noting the second-half outlook is “significantly de-risked” and supported by stabilizing market share, solid margins, and emerging multi-family demand.

The mean price target of $140.95 is not quite as ambitious, representing a premium of 2.5% to BLDR’s current price. However, the Street-high price target of $185 suggests an upside potential of 34.6%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.