Up 380% in 2025, Is It Too Late to Buy MP Materials Stock?

MP Materials (MP) stock surged over 4% on Friday, Aug. 8, capping off a remarkable more-than-380% gain in 2025 following record-breaking quarterly results and transformative government partnerships.

The rare earth mining company posted encouraging second-quarter results, narrowing its adjusted loss to $21.37 million from $28 million year-over-year, while sales nearly doubled to $57.4 million. The standout metric was record neodymium-praseodymium oxide production of 597 metric tons, a staggering 119% increase that underscores MP’s operational scaling.

Two major deals have fundamentally altered MP’s trajectory. The U.S. Department of Defense’s $400 million preferred stock investment makes the federal government MP’s largest shareholder while establishing a price floor for NdPr and guaranteeing 100% offtake from a new magnet facility. This provides unprecedented revenue visibility in the volatile rare earth market.

Moreover, Apple’s (AAPL) $500 million commitment to purchase rare earth magnets and help launch a recycling facility validates MP’s technology and creates a blue-chip customer base. These magnets are critical for electric vehicle motors, robotics, and consumer electronics.

CEO James Litinsky emphasized the company’s progress toward “commercial magnet production later this year” at its Fort Worth facility, which will supply General Motors (GM) and other manufacturers.

While the 380% gain reflects genuine operational improvements and strategic partnerships, investors should consider whether current valuations adequately reflect execution risks.

Is MP Materials Stock Still a Good Buy Right Now?

Recent investor conferences and earnings calls reveal the ambitious scope of MP Materials’ transformation from a struggling mine into what CEO James Litinsky calls an “American National Champion” positioned for the “era of physical AI.”

Management recently detailed plans to expand from 6,075 tons of refined NdPr oxide annually to potentially 9,000 tons as upstream production scales to 60,000 tons of rare earth concentrate.

CFO Ryan Corbett emphasized that recent optimizations have achieved record concentrate grades without sacrificing recovery rates, positioning MP Materials for significant midstream expansion.

One of the key reasons for government and commercial interest in MP Materials is that China currently has a dominant position in the rare earth market and there is interest in building up a U.S. supply chain. “We had auto factories actually shut, and there were a lot more that were very close to shutting from the export restrictions from China,” Corbett explained, highlighting the supply chain vulnerability that MP aims to solve.

MP’s 2026 heavy rare earth refining circuit will make it the only such facility outside China’s sphere of influence.

The Apple partnership extends beyond simple procurement to establishing scaled recycling capabilities. This initiative could expand production capacity without additional mining while reducing costs through the recovery of materials. Management views recycling as both a supply chain advantage and a potential revenue multiplier.

Litinsky positioned MP as uniquely suited for the “physical manifestation of AI” through robotics and autonomous systems. The company’s magnets are essential for electric vehicle motors, industrial automation, and emerging robotics applications – markets experiencing explosive growth.

What Is the Target Price for MP Materials Stock?

Analysts tracking MP Materials stock forecast revenue to rise from $204 million in 2024 to $1.42 billion in 2029. Comparatively, it is forecast to end 2029 with adjusted earnings per share of $2.37, compared to a loss of $0.44 per share in 2024. If MP stock is priced at 40x forward earnings, which is not too expensive given its growth estimates, it should trade around $95 in early 2029, 30% above current prices.

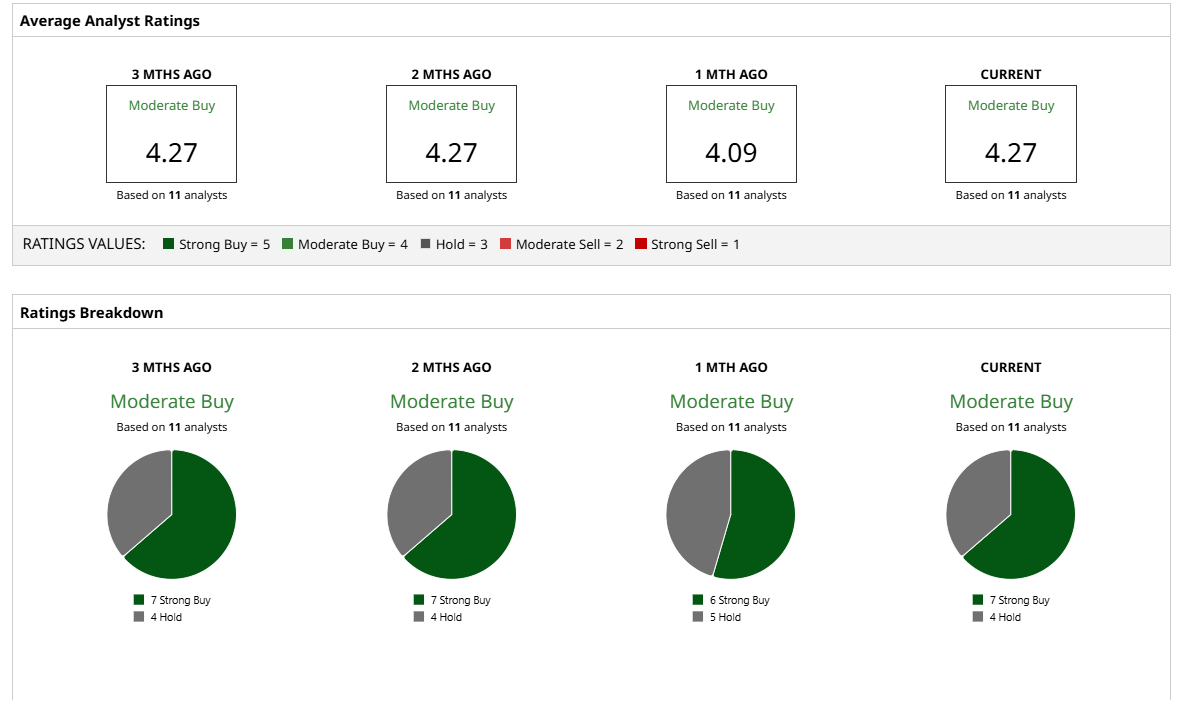

Of the 11 analysts covering MP Materials stock, seven recommend “Strong Buy” and four recommend “Hold.” The average MP stock price target is $61, below the current price near $75.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.