After Earnings, Pair Cisco with This Other ‘Chip’ Stock for Maximum Results

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

If you were listening to this article instead of reading it, things might be more confusing. Because when comparing two companies whose names sound identical, you either have to see it in print, or explain which one you mean. Back in my days of managing money, when giving instructions to a trader verbally, I had to be careful to include the ticker symbol, not simply say Cisco (CSCO). Or was it Sysco (SYY)?

As it turns out, the two stocks actually make a nice pair because they are such polar opposites.

I’ve found over the years that they each represent the constant tug-of-war between investor emotions. We want growth stocks, with strong earnings acceleration, on the cutting edge of technology. We also want stability.

Some have taken to comparing Nvidia’s (NVDA) leading edge in AI to CSCO’s role in leading the charge to power the internet. In perhaps a cautionary tale, CSCO surged into the dot-com bubble top in 2000, but then lost the vast majority of its value. It took 25 years to recover that peak stock price. Yet CSCO and NVDA are each part of today’s Dow Jones Industrial Average ($DOWI).

You might know the other half of the pair, SYY, if you’ve ever eaten at a restaurant. Sysco supplies everything from napkins to tuna salad. Whatever a restaurant needs! And it is the biggest company in its niche.

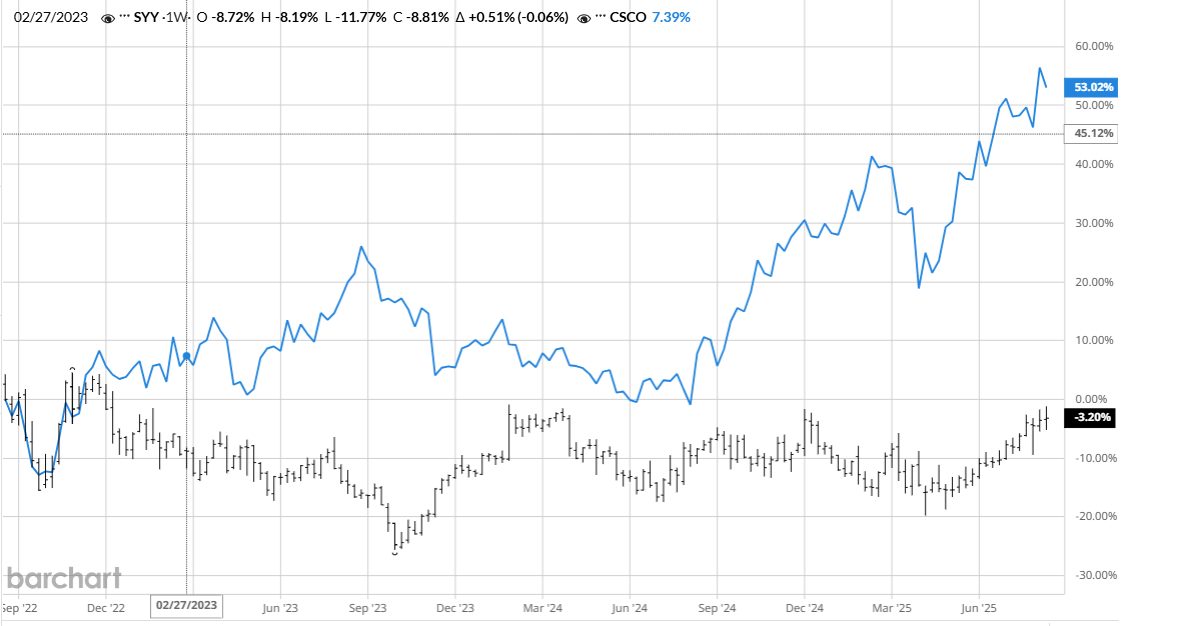

Comparing ‘Chip’ Stocks

When we consider the 180-degree difference between the (computer) chips business of CSCO and the (potato) chips business of SYY, we can start to understand how this stock pair is a proxy for “risk on” versus “risk off.” This chart shows 6-month rolling returns of these two companies going back a few years. They are mirror images as often as they are in sync. I suspect there are many such pairs in this tech-dominated stock market.

Now that we have separated the pair anecdotally and also shown their often divergent performance, let’s compare the stocks in more detail.

A few things stand out as I look at this custom snapshot I created using Barchart’s stock comparison tool.

CSCO, not unexpectedly, is more volatile, but in this bull market for tech stocks, it has outdistanced SYY over multiple time frames. Yet SYY has grown its earnings and revenue by greater rates over the past 5 years. Both stocks have decent yields for their sectors.

CSCO trades for a higher multiple, but SYY at 17.6x times seems a bit high. It is in the food biz, not contributing to next-generation technology. That said, selling at less than 0.5x sales, SYY is a bargain on that measure.

CSCO’s Chart Looks Better Than SYY

CSCO’s earnings threaten to alter its path, which has been decidedly higher. That 50-day moving average in green is rising nicely. And the percentage price oscillator (PPO) at the bottom has some kick to it. Still, earnings are THE biggest threat to any stock’s rally.

Alternatively, the stock rallying into earnings as it has could also be the start of a bigger move.

SYY announced earnings 2 weeks ago, and the stock has floated higher since that time. The PPO indicator at the bottom of the chart may be foreshadowing a top here.

The Bottom Line

Whether you invest in tech, consumer stocks or both, it helps to understand how they differ. And what they have in common. And in the case of CSCO and SYY, it helps to memorize your stock symbols, to avoid confusion.

Ironically, the SYY-CSCO combination might actually work best as a pair. And while that particular fact is a part coincidence, based on the company names, it reminds us that there’s still room for some good, old-fashioned diversification amid the “tech or bust” mentality that continues to have the market’s rapt attention.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.