CoreWeave Is In a Hypergrowth Phase. How Should You Play CRWV Stock Here?

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) is in a hypergrowth phase, thanks to the significant demand for its artificial intelligence (AI) cloud services. The company runs a network of purpose-built data centers across the U.S. and Europe, stocked with top-tier GPUs, CPUs, high-speed networking systems, and vast storage. All of these are essential infrastructure for hyperscalers and large enterprises. Beyond hardware, CoreWeave has developed proprietary software and services, creating a full-stack platform tailored for next-generation AI applications.

The solid demand for its AI infrastructure is reflected in its share price and financials. Since going public at $40 a share, CoreWeave’s stock has nearly tripled. This rally shows the company’s solid growth. For instance, CoreWeave’s revenue for the first time has crossed the $1 billion mark as the company reported $1.21 billion in revenue, up 207% year-over-year. Adjusted EBITDA jumped to $753.2 million from $249.8 million a year ago, while adjusted operating income more than doubled to $199.8 million from $85.4 million.

Looking ahead, management expects third-quarter revenue between $1.26 billion and $1.30 billion, slightly above Wall Street’s expectations. Further, for the second consecutive quarter, it raised its 2025 revenue outlook. CRWV’s management now projects $5.15 billion to $5.35 billion in revenue, up from its prior forecast of $4.9 billion to $5.1 billion. The optimism stems from significantly high customer demand, growing infrastructure capacity, and a robust backlog of orders.

Despite the stellar numbers and upbeat guidance, CoreWeave’s stock tumbled 20.8% on Aug. 13, immediately following the Q2 report. The market’s negative reaction and a sharp drop to a solid quarter and upbeat outlook indicate caution, at least in the short term.

Here’s Why CRWV Stock Dropped Post Q2

While CoreWeave is firing on all cylinders and poised to deliver significant growth, the stock could remain highly volatile in the near term. A key reason is the upcoming expiration of the post-IPO lock-up period, which ends today, Aug. 14. This will allow early investors and insiders to sell shares. This move often stirs short-term volatility.

Adding to the uncertainty is CoreWeave’s pending acquisition of Core Scientific (CORZ). The market is expecting that the deal could lead to share dilution.

At the same time, CoreWeave is rapidly expanding its infrastructure, bringing significant new capacity online. This growth push requires upfront spending before the related revenue starts flowing in, which can pressure margins in the short term.

Should You Buy CoreWeave Stock Right Now?

CoreWeave’s long-term growth story remains compelling. It is rapidly scaling operations to meet surging demand from a diverse customer base, with plans to deliver more than 900 megawatts of active power by year-end. This expansion is supported by strong order growth and an expanding client base, positioning CoreWeave for a multiyear runway of growth.

At the close of the second quarter, CoreWeave reported a contracted backlog of $30.1 billion, a $4 billion jump from the previous quarter and twice the amount recorded at the start of the year. This backlog includes a $4 billion expansion deal with OpenAI as well as new partnerships with both large enterprises and promising AI start-ups. Notably, CoreWeave has also signed expansion contracts with both of its hyperscale customers in just the past two months. Its pipeline remains strong and increasingly diverse, spanning various industries.

The company is also seeing notable traction in its backbone and networking services. One of the largest AI labs is now leveraging CoreWeave’s infrastructure to connect a multi-cloud inference system. With a robust product roadmap, the company plans to roll out additional cloud services and capabilities over the coming months, which will likely accelerate its growth.

CoreWeave has also been diversifying its funding sources to lower its cost of capital, which augurs well for growth. Further, its strategic acquisitions, including Weights & Biases and the pending purchase of Core Scientific, are set to strengthen its infrastructure and operational efficiency, allowing it to scale faster while advancing its product offerings.

Taken together, CoreWeave’s purpose-built AI cloud infrastructure makes it a go-to platform for customers across the spectrum, and its long-term growth case looks solid. That said, the road ahead is unlikely to be perfectly smooth. Investors should expect some short-term volatility.

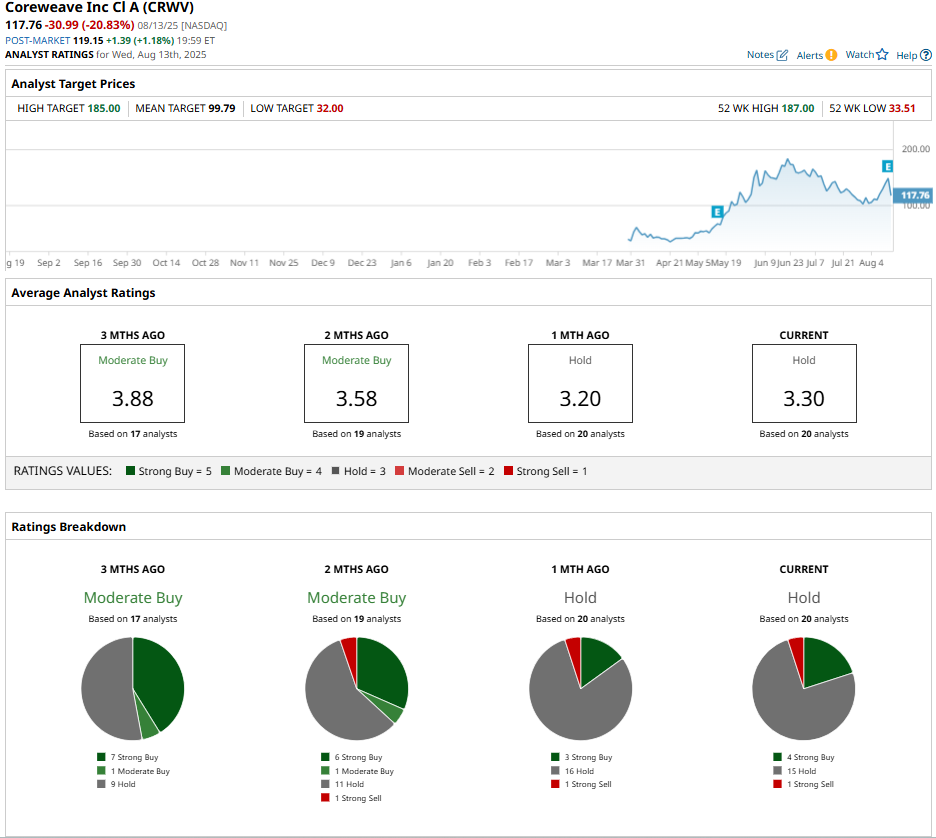

Wall Street remains cautious, with analysts maintaining a “Hold” consensus on CRWV. This implies that investors should show patience, waiting for the stock to stabilize before buying.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.