Are Wall Street Analysts Predicting American Water Works Stock Will Climb or Sink?

With a market cap of $28.1 billion, American Water Works Company, Inc. (AWK) is the largest publicly traded water and wastewater utility in the U.S., serving about 14 million people across 14 states and 18 military installations. Founded in 1886 and headquartered in Camden, New Jersey, the company operates thousands of treatment plants and an extensive distribution network, supported by roughly 6,700 employees.

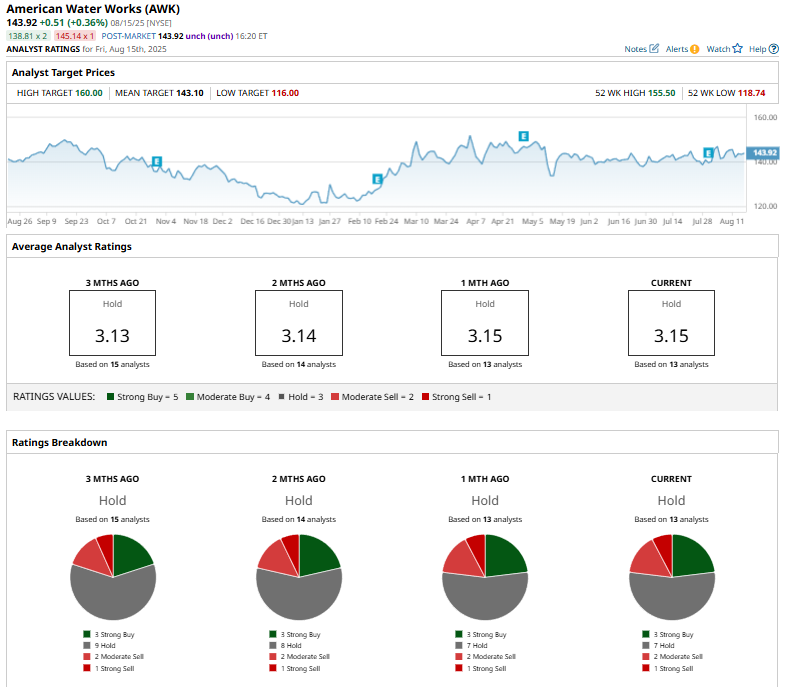

Shares of the utility titan have underperformed the broader market over the past 52 weeks, rising 1.3%, compared to the broader S&P 500 Index ($SPX), which has rallied 16.4%. However, shares of AWK are up 15.6% on a YTD basis, outpacing SPX's 9.7% gain.

Looking closer, the water utility has lagged behind the Utilities Select Sector SPDR Fund's (XLU) 15.5% increase over the past 52 weeks and 13.1% climb in 2025.

On July 30, American Water Works’ stock dipped marginally following the release of its fiscal Q2 2025 results. The company posted EPS of $1.48, up from $1.42 in the prior-year quarter, while operating revenue climbed 11.1% year-over-year to $1.28 billion. Management also tightened its full-year 2025 EPS guidance to a range of $5.70–$5.75 on a weather-normalized basis, compared with the previous range of $5.65–$5.75.

For the current fiscal year, ending in December 2025, analysts expect AWK's EPS to grow 5.9% year-over-year to $5.71. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

Among the 13 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, seven “Holds,” two “Moderate Sell,” and one “Strong Sell.”

On August 14, Argus Research analyst John Eade reaffirmed a "Buy" rating on American Water Works and raised the price target from $155 to $160, which is also the Street-high price target.

It currently trades above its mean price target of $143.10.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.